Trevor Noah is a comedian, Emmy-award winning host of The Daily Show, and author. He was keynote speaker at Canada's largest Real Estate Conference & Trade Show—TRREB REALTOR® QUEST 2023 at the Congress Centre in Toronto.

Cheryl Hicky is ET Canada Co-Host, and was the keynote moderator.

Van Hansen attended 'A Conversation with Trevor Noah' this May, and presents an abridged transcript of the presentation here.

TORONTO

Cheryl Hickey: I'm just so excited to sit down with you. I know that you spent some time in Toronto with your Netflix special so my question is this, are you looking for a home? And what kind of home are you looking for? Like, do you need a stacked dishwasher? Do you want a pool? I know some real estate agents that...

Trevor Noah: I like this, this is full service.

Cheryl Hickey: I just want to know.

Trevor Noah: This is full on, this is the Canadian hospitality I've been promised.

Cheryl Hickey: What do you need?

Trevor Noah: You're going to help me find a home?

Cheryl Hickey: I will drive you.

Trevor Noah: Okay, okay.

Cheryl Hickey: I'll take you where you need to go.

Trevor Noah: Alright, I'm in, I'm in, I'll take it.

Cheryl Hickey: Do you love Toronto?

Trevor Noah: I do, I've had a great time out here. I love Toronto I've loved all of Canada and in all the time I've been lucky enough to come out here I've really enjoyed myself, you know, every place has a different vibe to it you know Toronto has like a very polite bustle as I like to call it you know.

I found I really enjoyed Vancouver. It's got like a beautiful, you know, just like an energy to it. And then Montreal is very French. It's lovely. So I've really been lucky to not just enjoy myself, but be welcomed every time I come to Canada.

UPS & DOWNS

Cheryl Hickey: Your path to success from stand up to even acting in a soap and then certainly to The Daily Show has been so incredible and what a journey it's been to watch and to see. And perserverance seems to be a thread throughout it all. Can you talk about or share some ups and downs and struggles that you've overcome throughout that time period that maybe the team here can learn from?

Trevor Noah: Ups and downs! Life is ups and downs. It is a constant journey of ups and downs, becauseI think we forget the great paradox of every success is that you are higher up for the next down, you know.

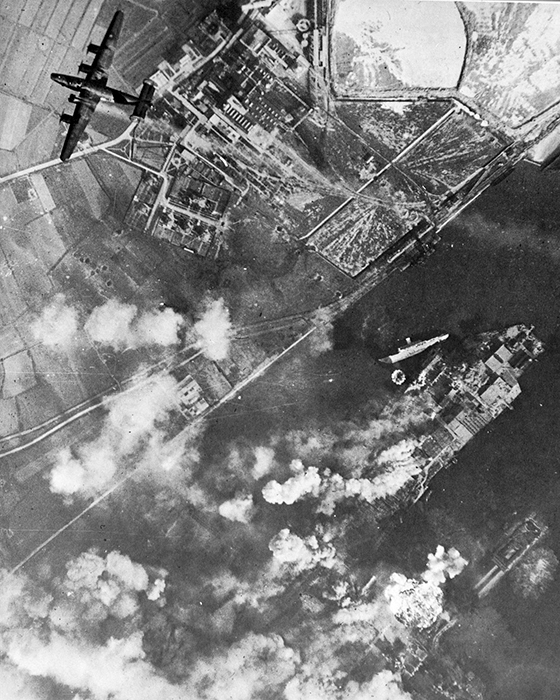

I grew up in a country that was finding itself in a new democracy. I grew up in a family where my mother was a single mom who was forced to be such because of the country's laws that restricted people of different races being together.

I grew up in a familv that was try ing to make ends meet. And so there were many times when we couldn't eat or there were many times when we struggled just to make ends meet-but then there were many times when we were laugning when things were going well and my grandmotner was cooking the food that my mom and my aunt and evervbody was able to cobble together.

So the ups and downs are constant in life you know I always tell people every single moment, every single failure. is the reason I got to my success.

It's a weird thing to accept you know, one of the phrases I use for myself is let everything in life be an answer to a question you already have.

What I mean by that is, oftentimes we only see something that is happening to us to be good or bad And what we often fail to do is let the bad, or let the thing that is happening to us be an answer. Just an answer to a question.

Should vou be doing what vou're doing? Do you have to work on your resilience? Are there answers that you can garner from this? Are there lessons?

The greatest paradox in life is that resilience only comes from come sort of adversity. It's tough but it's true you cannot become stronger without some sort of resiliency you know it's like when you go to the gym the reason you become stronger is because you have to lift weights and you have to it's terrible but that's the reason you become stronger you know if it's not terrible in the gym then you're not going to become stronger you're having a good time but it's not going to make you stronger.

Cheryl Hickey: So all those people on Instagram and stuff are faking it that they're having a good time?

Trevor Noah: Oh yeah, definitely. Yeah, they're not.

Cheryl Hickey: I just want to make it clear.

Trevor Noah: Or they've convinced themselves to now enjoy the adversity, which is a good thing.

Cheryl Hickey: Which is a really good thing. Fake it till you make it. I'm a person who loves working out.

Trevor Noah: Yeah, there it is. And so I think, you know, in all of my journeys, stand-up comedy is constatnt failure. That's what stand-up comedy is. It's you trying to tell an audience jokes and every time they're not laughing, you're failing and then you're gaining and garnering infromatino for what you then wish to say the next time you're in front of an audience.

You know, every business venture I entered into that didn't work pushed me to the area that it did and so yeah I think that's the hardest thing to accept in life is that you are not trying to achieve constant success, but what you're trying to do is use your failures as information that become the seed that grows your next success.

And that's really difficult to understand and achieve because of how debilitating some of your failures might feel.

Cheryl Hickey: For sure. Who do you get that from? Were you born with that soret of insight in your soul or was that from your mom?

Trevor Noah: No, I think definitely from my mom. Yeah. I saw my mom do everything yo know so my mom's a real estate agent a lot of people don't know that.

Trevor Noah: No, I think definitely from my mom. Yeah. I saw my mom do everything yo know so my mom's a real estate agent a lot of people don't know that.

It's true and one of the reasons my mom got into real estate was because she loved the idea of creating a few areas in our world and in the world that she felt hadn't been fulfilled. So one was owning property in areas that black people have been excluded from for a very long time.

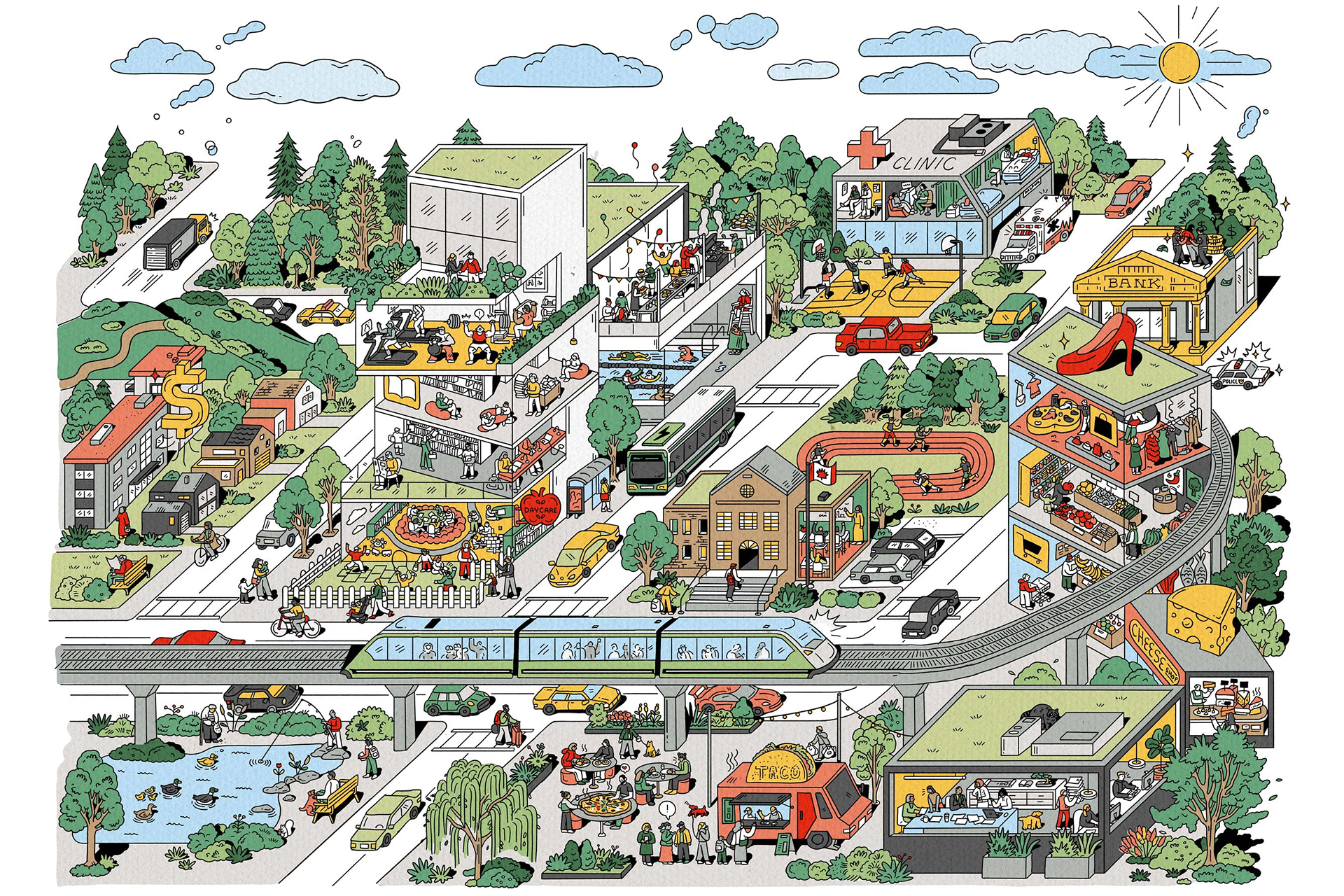

That was always our dream was to not drive an hour to get to school and to work. You know, that was one of the dreams that my mom was able to achieve. And then beyond that, it was just like finding a way to provide sustainable and affordable housing to people who couldn't necessarily access it. And that's really the position you're in when you're in this job.

You are the person who is trying to connect somebody with an answer. You are the person who is trying to connect somebody with what they wish for, what they can get, what they hope to et, where they're going to start their life, what they're going to do. You know what I mean? And I would watch that journey.

How my mom got into it was just by being a secretary. You know, that's how she started. And she tells me the storv of how she worked at a real estate agency and her boss was just like a full-on drunk. He just partied hard and he would come in drunk every day. And because of that, he never did his work.

So she had to do his work, which is a terrible situation to be in except for the fact that she now learned in an environment where she wouldn't otherise if she had a really efficient boss and she only had to do the part of her job that she had to do that would have been it forever.

But instead now here she was handling title deeds and here she was understanding what needed tobe moved around and what land surveyor needed to do what with which parcel of land and here she was understanding what needed to be appraised and how it needed to be appraised, et cetera.

She was learning. And then because of that, she was like, well, now that I've done the learning, maybe I should go and get mv license and actually apply what I've learned. But that was an adversity that she then turned into a gift. And so that's definitely something that I've inherited.

IMAGINATION

Cheryl Hickey: Another gift, what I read in your book that she you that I thought was so clever is drivingaround neighbourhoods, looking at homes and creating, helping you foster imagination. How important has that been in your life?

Trevor Noah: Oh, it's been one of the most important things. I even say in the book, you know, people always tell you to dream and to imagine, but you can only imagine what you know. It's a real conundrum. It's a paradox. You know?

And so one of the best things vou can do for anvone in life is to explore the possibilities of what youare able to think about, you know? What are the ultimate constraints of your mind.

That's why reading is so fantastic because it's almost the explosion of your imagination up against somebody else's. It's that compounding effect.

So my mom used to do that. She'd drive me around. We would come back from church every Sunday and what my mother would do is instead of just driving us home she would drive us to really really nice neighbourhoods. right?

And these were predominantly white neighbourhoods where we would never be able to afford to live there, like never and we'd get there and they had these massive walls. You couldn't see the house onthe inside. And then what my mom would do is, we'd park the car and then we'd just I'd point at a house and I'd be like, that one!

And we'd walk up to the wall and then my mom would lift me up onto her shoulders like a little periscope. And then I would look over the wall and then she would say, what do you see?

And I'd be like, they have a tennis court! And they've got a swimming pool! And they've got rose bushes! And I'd just describe the whole thing and then she dropped me down and she's like okay let's go to another one and then we'd look at another house.

I always imagined what it was it must have been like if you were on the inside, because you were in the house at your pool, and you just see a very tall child just like popping up over your wall you'd be like is that an eight or nine foot tall seven year old child? What is happening here? And why are they describing my yard? That's essentially what it was.

But what I loved about that is that it just showed me what was possible. It showed me what was out there. It showed me a world that I may never have access to, but yet knew existed.

Cheryl Hickey: She gave you that whole if you see it you can be it. She was like no, this is there.

Trevor Noah: Just to know that it's there. I live in New York City and I speak to people today who have still never left their borough. You'd be shocked at how many people live in Harlem and have never been to Times Square. My mind was blown by that. And yet that is common around the world.

There are so many people who do not understand or do not know what exists in the world because nobody has just held their hand and lifted them over a wall to see something.

Cheryl Hickey: That's right. What a gift she gave you!

Trevor Noah: Yeah, absolutely.

MAKING CONNECTIONS

Chery Hickey: A big bart of realtor's jobs of course, is connecting with people and connecting with families and you are one of the best at it--you're really aood at communicating and bringing peopletogether. What do you think some keys to that kind of communication are for people who arelistening, to get to the families, to get to the neighbourhood?

Trevor Noah: I think the first and most important thing when getting to know anybody is to be interested.

I find in my experience that's been the difference between every great real estate agent I've ever met and every real estate agent who just feels like they're going through the motions. It's them being interested. Sometimes you walk into an open house and it feels like you're a breeze flowing from onedoor to the next. And you're just like, okay, but thev're not interested.

People take for granted what an emotional journey buying or renting a home is. It's the place you will exist in. I think people really take that for granted, and I find that's the difference between great real estate agents and, you know, people who are just doing the job.

There are people who will ask you, they will listen to you, they will want to know, how do you enioy living? What do vou wish to achieve? Where are vou trying to get to?

You know, okay, you may not be able to get what you want now, but can we get you close to that? Can we find the gap that can be bridged?

Sometimes the person doesn't even know that there is something that they want because they're basing their wants and their needs on everything that they've experienced beforehand.

You know, the only style you know in a house is the style that you've been exposed to. It's when somebody else takes an interest in you and savs, have vou ever seen this style of home? And you'relike, I don't know.

And they're like, well, let's see it. And let's see what you like about it. Let's see what you don't like about it. They're interested in you as a human being.

And I think that's the thing people should never forget. You're dealing with human beings. It doesn't matter who it is. It doesn't matter if it's like a Hollywood star who's in movies or you know, it's just somebody off the street who's coming to you because they want to find a place to stay. They're a human being. Everyone is.

And so if you treat them accordingly with a certain level of interest, an interest that you would hope somebody would pay to you, you will find that you'll connect with them in an interesting way.

And I found oftentimes, I found the mistake most people make is thinking that every transaction is concluded on the day that it begins when in fact, a transaction may be concluded in 20 years from now. You don't know. You genuinely don't know.

I always say, specifically in the world of real estate, because I love seeing houses, I love going and seeing where will I stay, what will I do, what will I not do, et cetera, et cetera.

I've always loved the realtors who are, they're just like, they're patient with you, they care, they understand that you're not wasting their time, you're trying to find the place.

And I know it can be annoying, I'm sure it is. There's someone being like, well, I don't know about this, I don't know about this, I don't know about this. You don't know about anvthing. Yeah, but that's what it is, yo know.

And I find that veah the best ones are always the ones who they almost like take a take a mental note and they start knowing you. They'll start saying to you "I don't know if this is for you I know the pictures look like that, but knowing you I don't think it's your vibe.

Yeah, and it's just them being interested. What is it that you enjoyed in the places you enjoy and what is it that you didn't enioy in the places you didn't enioy? And I find that beyond even business connects you with human beings.

Cheryl Hickey: Would you be a good real estate agent? I mean it begs the question.

Trevor Noah: I think so. I think so. Yeah. Are you kidding me? Yeah, I think I'd be fantastic at it.

Cheryl Hickey: I feel like we should go and try and sell a couple houses.

Trevor Noah: I promise you I would be fantastic at it. You know why because I love it itself. Yeah, and that's the most important thing when I walk into a home I'm enioying it more than most real realtors who are showing me around, you know?

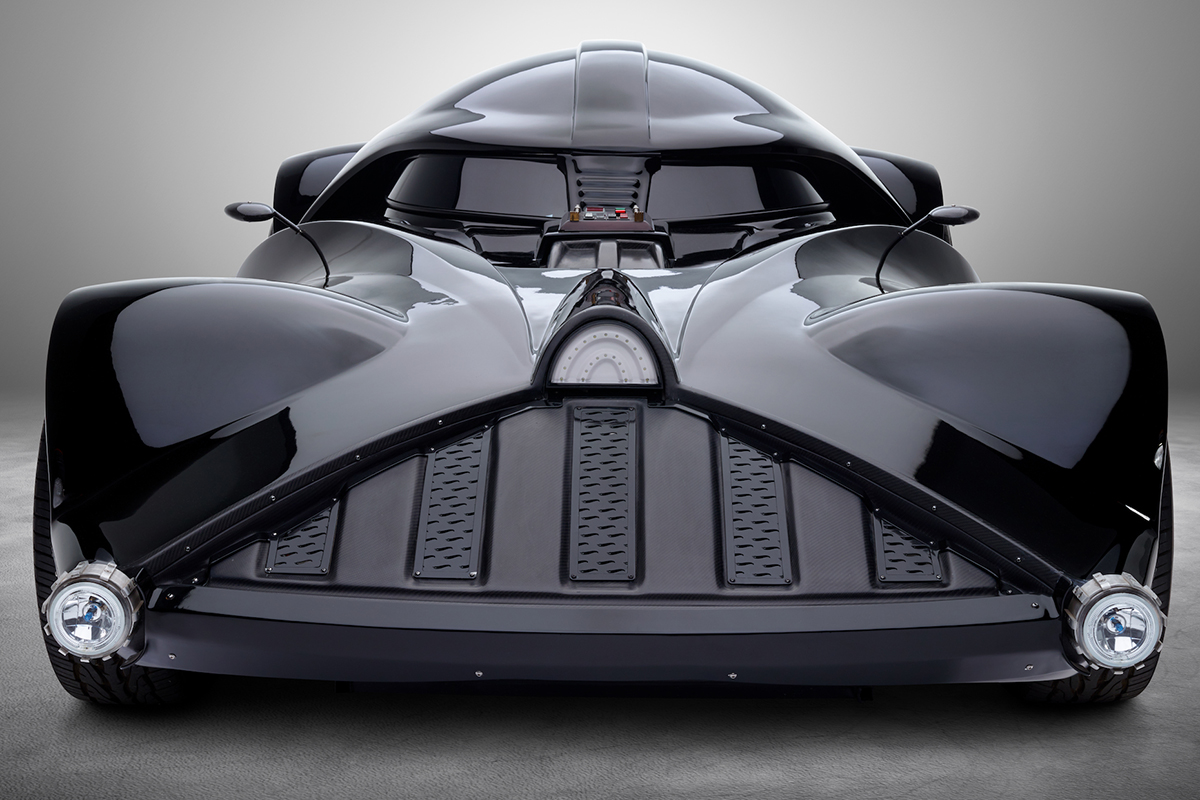

I want to know how and why it was built why it's shaped the way it is why did the architect design it the way that they did. Why is this room here, in that room there who chose carpet? Why do they always choose carpets? All these things are in my head when I'm walking around.

I really enioy it. And I think that's one of the most important things. And I enioy fulfilling that need. I think that's one of the greatest joys vou can experience. There's nothing greater than finding somebody who needs something and fulfilling that need have you seen how happy people are when they get the right home?

Not when they're pushed into buving a home not when they're like tricked into it not when they've been like bamboozled. Oh, we've got multiple offers. You've got to act now! The best realtors are the ones who've said to me like hey yo relax, relax. Hey. it's okay relax. You know?

Cheryl Hickey: So, our time is up. I have one last question, which is when are you moving?

Trevor Noah: When am I moving?

Cheryl Hickey: Here.

Trevor Noah: To Toronto?

Cheryl Hickey: Yeah, for a bit.

Trevor Noah: Okay.

Cheryl Hickey: Right? Okay. I feel like it's the question.

Trevor Noah: Okay. Well, I mean, I would have to live in a neighborhood that's close to Jamaican patties so..

Chery Hickey: So we can do that. We absolutely can do that.

Trevor Noah: I find a lot of my real estate decicions are baced on food. That's like my keyword when I search—food. Yes. Close to great food places. That's me. So if you can find me some Jamaican food. Oh, you've got amazing Jamaican food in Toronto I know that. Something like that?

So Where is the warm part of Toronto right? That's another thing I'm looking for.

Chery Hickey: We'll work on that part, how about that.

Listen, a wise man once said that the greatest gift you can give someone is to be chosen and I am so grateful that you chose to be here with me, have this conversation and to be here with everyone else. And by the way that wise man is Trevor. Trevor Noah everybody!

Trevor Noah: Thank you everybody!

__

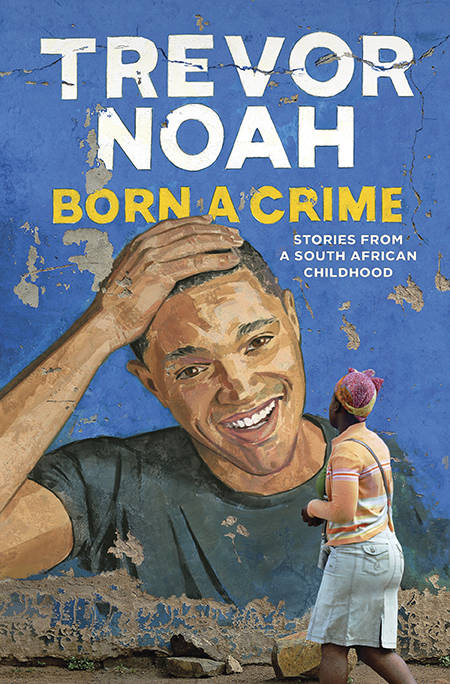

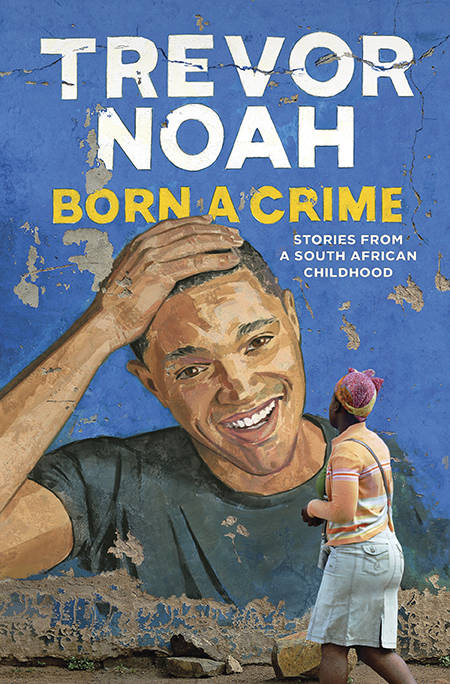

Born a Crime by Trevor Noah

From Penguin Random House Canada:

The compelling, inspiring, and comically sublime New York Times bestseller about one man's coming-of-age, set during the twilight of apartheid and the tumultuous davs of freedom that followed.

Trevor Noah's unlikely path from apartheid South Africa to the desk of The Daily Show began with a criminal act: his birth. Trevor was born to a white Swiss father and a black Xhosa mother at a time when such a union was punishable by five vears in prison. Living proof of his parents' indiscretion, Trevor was kept mostly indoors for the earliest years of his life, bound by the extreme and often absurd measures his mother took to hide him from a government that could, at any moment, steal him away.

Finally liberated by the end of South Africa's tyrannical white rule, Trevor and his mother set forth on a grand adventure, living openly and freely and embracing the opportunities won by a centuries-long struggle.

Born a Crime is the story of a mischievous young boy who grows into a restless young man as he struggles to find himself in a world where he was never supposed to exist. It is also the story of that young man's relationship with his fearless, rebellious, and fervently religious mother—his teammate, a woman determined to save her son from the cycle of poverty, violence, and abuse that would ultimately threaten her own life.

The eighteen personal essays collected here are by turns hilarious, dramatic, and deeply affecting. Whether subsisting on caterpillars for dinner during hard times, being thrown from a moving car during an attempted kidnapping, or just trying to survive the life-and-death pittalls of dating in high school, Trevor illuminates his curious world with an incisive wit and unflinching honesty. His stories weave together to form a moving and searingly funny portrait of a boy making his way through a damaged world in a dangerous time, armed only with a keen sense of humour and a mother's unconventional, unconditional love.

2024%20VanHansen.jpg)

Per_Morten_Abrahamsen.jpg)

2016_Van_Hansen-560-wide.jpg)

2023_van_hansen-560-wide.jpg)